USDA loan refinance: Convenient Solutions for Reducing Your Loan Term.

Attain Lower Settlements: Essential Insights on Funding Refinance Options

Loan refinancing presents a critical chance for home owners looking for to minimize their regular monthly payments and total economic obligations. By taking a look at various refinance choices, such as rate-and-term and cash-out refinancing, individuals can tailor services that line up with their details financial scenarios.

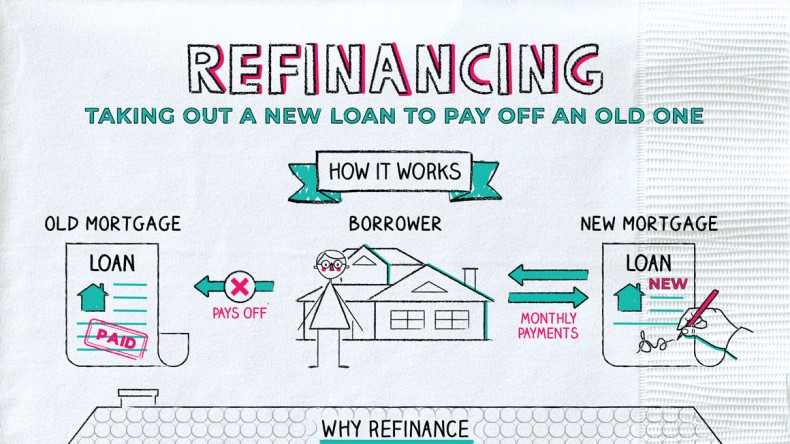

Recognizing Financing Refinancing

Car loan refinancing is a monetary approach that permits consumers to change their existing lendings with brand-new ones, usually to secure a lot more desirable terms. This process can result in lower rate of interest, minimized month-to-month repayments, or a different finance period that much better straightens with the borrower's economic goals.

The key inspiration behind refinancing is to boost financial versatility. By examining present market problems, customers might locate that passion prices have actually lowered given that their initial car loan was taken out, which might lead to substantial savings gradually. Furthermore, refinancing can supply chances to consolidate financial obligation, changing numerous high-interest commitments into a solitary convenient settlement.

It is essential to consider the linked prices of refinancing, such as closing costs and other expenses, which can offset prospective financial savings. Examining one's financial circumstance and long-lasting goals is necessary prior to committing to refinancing.

Sorts Of Refinance Options

Re-financing offers numerous options customized to satisfy varied economic requirements and goals. One of the most common types consist of rate-and-term refinancing, cash-out refinancing, and improve refinancing.

Rate-and-term refinancing allows consumers to adjust the interest rate, car loan term, or both, which can cause decrease month-to-month repayments or lowered general rate of interest expenses. This choice is commonly gone after when market prices drop, making it an attractive option for those looking to minimize interest.

Cash-out refinancing makes it possible for house owners to access the equity in their building by borrowing even more than the existing home loan balance. The difference is taken as cash, offering funds for major expenditures such as home restorations or financial debt loan consolidation. This choice increases the total car loan amount and may influence long-lasting economic stability.

Each of these refinancing types uses distinctive advantages and factors to consider, making it crucial for borrowers to evaluate their particular monetary scenarios and objectives before continuing.

Benefits of Refinancing

Refinancing can supply numerous monetary benefits, making it an eye-catching alternative for numerous. If market prices have decreased considering that the original mortgage was safeguarded, house owners may refinance to obtain a reduced rate, which can lead to reduced regular monthly payments and significant cost savings over the financing's term.

In addition, refinancing can aid homeowners accessibility equity in their building. By deciding for a cash-out refinance, they can convert a section of their home equity right into cash, which can be utilized for home enhancements, financial debt combination, or other economic demands.

One more advantage is the possibility to transform the funding terms. House owners can switch from a variable-rate mortgage (ARM) to a fixed-rate home loan for higher stability, or reduce the lending term to pay off the mortgage much faster and save on passion costs.

Factors to Take Into Consideration

Prior to deciding to refinance a mortgage, house owners must meticulously evaluate numerous vital aspects that can considerably impact their economic situation. The present rate of interest rates in the market ought to be evaluated; refinancing is typically useful when rates are lower than the existing home mortgage price. In addition, it is necessary to take into consideration the staying term of the current home mortgage, as extending the term can lead to paying more passion with time, in spite of reduced regular monthly settlements.

Last but not least, property owners need to evaluate their lasting monetary objectives. If preparing to relocate the future, refinancing may not be the most effective alternative (USDA loan refinance). By meticulously considering these elements, house owners can make enlightened decisions that line up with their financial objectives and overall stability

Actions to Refinance Your Loan

As soon as house owners have actually reviewed the crucial factors affecting their choice to refinance, they can wage the needed steps to finish the procedure. The very first step is to figure out the type of you can try these out re-finance that best fits their economic objectives, whether it be a rate-and-term refinance or a cash-out re-finance.

Following, homeowners need to gather all relevant economic files, consisting of earnings declarations, tax returns, and info regarding existing financial debts. This documentation will be necessary when making an application for a brand-new financing.

:max_bytes(150000):strip_icc()/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

Once a suitable lending institution is picked, house owners can send their application. The loan provider will certainly perform a detailed evaluation, moved here which may include an appraisal of the residential property.

After authorization, home owners will certainly receive a Closing Disclosure describing the terms of the brand-new lending. Finally, upon closing, the new car loan will pay off the existing home mortgage, and property owners can begin taking pleasure in the advantages of their refinanced financing, including lower regular monthly payments or access to cash.

Final Thought

In conclusion, finance refinancing provides a beneficial chance for homeowners to accomplish reduced settlements and ease monetary tension - USDA loan refinance. By comprehending various refinance alternatives, such as see here rate-and-term, cash-out, and simplify refinancing, individuals can make enlightened decisions tailored to their economic situations.